And among these six million it is the carers, shielders and key workers who are some of the the hardest hit.

One in 9 people, the equivalent of 6 million people across the UK, have reported falling behind on household bills because of coronavirus according to new research from Citizens Advice.

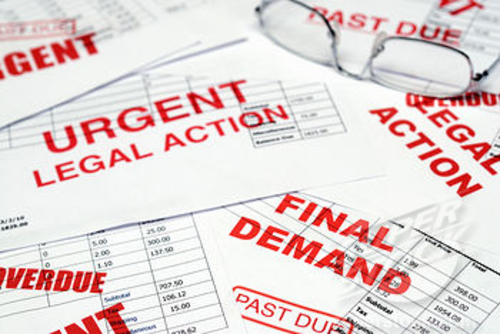

With protections against eviction for renters and the ban on face-to-face bailiff collection both ending shortly, the charity warns that many of those struggling may face harsh enforcement.

Those who care for someone older or younger, those who said they were shielding during the pandemic and key workers are all at least twice as likely to have fallen behind on a household bill because of coronavirus, according to a nationally representative poll of 6,000 people.

-

1 in 4 people who are parents or carers (24%) have fallen behind on their bills, compared to 1 in 14 people (7%) without caring responsibilities

-

1 in 5 people (22%) in the shielded group are behind, compared to 1 in 20 (6%) of people who are not shielding or at ‘increased risk’

-

1 in 5 key workers (21%) have fallen behind on their bills, compared to 1 in 14 (7%) of non key workers.

As well as the groups above, Black people, those aged 18-34 and disabled people are also at least twice as likely to have fallen behind (see no. 5 in Editors Notes for details).

This burgeoning coronavirus debt crisis has already had serious consequences for those behind on bills. Around a fifth of those behind on their bills have had to go without essentials – half of these people have gone without food. One in five have had to sell possessions to make ends meet during the pandemic.

Since March, the government has suspended the enforcement of repossession orders and barred bailiffs from visiting people’s homes. However, very shortly, both of these protections expire. This will leave people behind on their rent at the risk of eviction and those behind on bills, especially council tax, at risk of having the bailiffs knocking on their door.

Citizens Advice fears that many of those now in debt may never escape it. People who sought help with debt since March this year will need, on average, two and half years to pay back their current priority debts, which include household bills.

A lasting legacy of coronavirus debt would be harmful for people affected. The existing insolvency mechanisms would be slow, difficult to deliver and have damaging effects on their long-term financial situation, including impacting on credit scores.

Citizens Advice also fears that businesses, landlords and councils might face the prospect of being saddled with a mountain of unrecoverable debts that could affect their own viability. This, along with reduced consumer spending as people pay down debt, could hamper the wider economic recovery.

People in debt because of coronavirus need urgent financial support in order to deliver on the Prime Minister’s pledge to ‘build back better’. Citizens Advice is calling for one-off or time-limited financial support for arrears built up because of coronavirus, with the cost of relief shared fairly between government, creditors, and individuals. This would be tailored to each sector but could include grants, payment matching or government-backed loans.

Laura’s* story: Working 50 hour weeks to escape the cycle of coronavirus debt

At the beginning of March, mother-of-two Laura began a new job, working in healthcare administration. Alongside the wages from her new job Laura had also been receiving Universal Credit. She had some debts before the pandemic struck, but was keeping on top of her payments.

Laura suffers from a long-term health condition and, when the country went into lockdown, received a letter from her GP to say she needed to shield.

Laura’s employer told her it wouldn’t be able to furlough her and could only offer her two weeks’ pay. Being a new member of staff meant that she wasn’t offered the option to work from home, which was only given to longer standing members of staff.

The loss of income drove her into further debt – she’s now fallen behind on council tax, her phone bill and other debts.

Laura says: “Even though I had existing debts, before the coronavirus I was actually paying them off fine. But when I was told I had to shield and couldn’t be furloughed – which was a big shock – I stopped paying them and now I’m three months behind on council tax. All I could afford to pay was my rent and nothing else.

“I had a payday loan and now I’ve started to use that, I can’t really get out of it and I’m always in my overdraft. When I started this job I was OK financially but because of coronavirus and being off work for a couple of months, it’s put me back in a never ending cycle.

“Since being back at work I’ve been doing double shifts every single day. So I’m working 10 hour days, five days a week to get a better wage to help get me out of this cycle of debt.

“The whole situation has made me feel really down. I’m not the sort of person who likes asking for help, so I’ve struggled. I’ve felt a bit worthless to be honest and had to be prescribed antidepressants by my GP.”

Chris Whitehead, a debt advisor at Citizens Advice Newcastle, said:

“This is a crisis that nobody could have planned for financially and we hear daily from people how tough it’s been for them to deal with the immediate issues of putting food on the table, paying the bills and essentially just getting through the day.

“But we fear the debt problems, which have been building up during lockdown, are now coming to bear as the schemes aimed at preserving jobs and incomes come to an end over the next few months.

“We’re hearing from people who are struggling to keep their head above water after months on reduced incomes. From having fallen behind on a few bills, they will soon be at risk of losing the roof above their head, or being targeted by bailiffs. They are simply overwhelmed and at rock bottom.”

Dame Gillian Guy, Chief Executive of Citizens Advice, said:

“As the government takes steps to try to kickstart the economy, it must not forget the millions who’ve fallen into debt because of a crisis no-one could have foreseen.

“Protections put in place by the government, businesses and regulators have staved off the worst consequences of lockdown debt – so far. But with these measures beginning to end, millions will now face the repercussions.

“It is not right that people who’ve followed government guidance by shielding, stayed at home to care for others, been forced to work less, or lost their jobs altogether should be the ones left facing a financial black hole.

“Government and businesses must help them now. Financial support for those who’ve fallen into debt must be prioritised to free them from the damaging consequences of long-term debt, and help strengthen the economic recovery.”

Notes to the above

-

Laura’s name has been changed to protect her identity.

-

Opinium surveyed 6,015 adults online, between 29 June and 8 July. Data was weighted to be nationally representative of the UK

-

The household bills analysed by Citizens Advice are: Mobile phone or broadband bills (3.4 million behind), water bills (3 million behind), energy bills (2.8 million behind), Council Tax (2.8 million behind) and rent (1.2 million behind).

-

687 out of 6,015 respondents (11.4%) say they have fallen behind on at least one of the above bills because of coronavirus. Using the UK population estimate (Mid 2019: April 2020 LA Boundaries) of 52,673,433 adults (18+) in the UK, we can extrapolate that this has affected 6 million individuals

-

1 in 3 black people (31%) are behind on 1 or more bills, compared to 1 in 8 white people (12%); 1 in 5 people aged 18-34 (20%) are behind on 1 or more bills, compared to 1 in 12 people (8%) aged 35 or older; 1 in 6 disabled people (16%) have fallen behind on their bills, compared to fewer than 1 in 10 non-disabled people (7%)

-

1 in 5 (18%) BAME people are behind on 1 or more bills. However, our analysis shows significant variation between different ethnic minority groups, with Black people the most likely to have fallen behind on their bills (31%).

-

‘Priority debts’ are debts that can cause you particularly serious problems if you don’t do anything about them. They include: Rent arrears, Mortgage arrears or secured loan arrears, Council tax arrears, Gas or electricity bills and Phone or internet bills. A full list of what Citizens Advice considers ‘Priority Debts’ can be found here.

-

Citizens Advice is made up of the national charity Citizens Advice; the network of independent local Citizens Advice charities across England and Wales; the Citizens Advice consumer service; and the Witness Service.

-

Our network of charities offers impartial advice online and over the phone, for free.

-

We helped 2.8 million people face to face, over the phone, by email and webchat in 2019-20. And we had 34.5 million visits to our website. For full service statistics see our monthly publication Advice trends.

-

You can get consumer advice from the Citizens Advice consumer service on 0808 223 1133 or 0808 223 1144 for Welsh language speakers.